Reclaiming Council Tax

Council tax is a system excised on all residential or commercial properties in UK, Scotland as well as Wales. The council (property) tax is collected by the regional authority and also is distributed to the welfare of neighborhood neighborhoods such as police stations, garbage, libraries and so on.

Whether it is a house, cottage, level, maisonette, mobile homes, residence watercrafts, council (residential property) tax obligation is levied on all these regardless of the truth whether they are leased or possessed. By the Local Government of Finance act of 1992, eight council tax bands were created (coded by letters A to H) based on their funding worth on 1st April 1991.

The banding was performed in such a way that the residential or commercial properties in “Band H” needed to pay tax thrice the amount paid by the buildings in band A. The middle band “Band D” was made use of to review the tax obligation expenses across the United Kingdom, as well as was noted with the residential or commercial properties valuing ₤ 68,001 to ₤ 88,000.

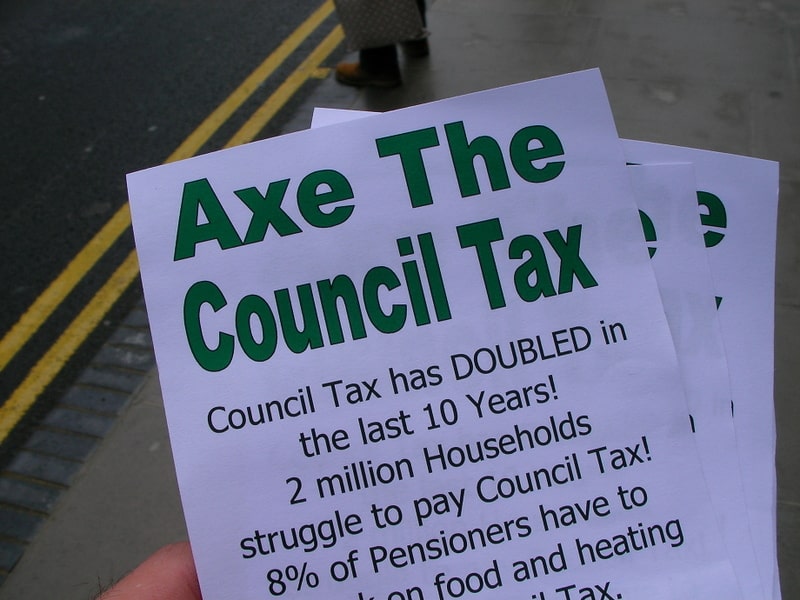

Nonetheless, because the time the residential properties were grouped, there have actually been whines from the property owners that they have actually been put under the incorrect property tax bands which forces them to pay excessive amount of taxes.

As a current data state, there are as lots of as 5 million houses which drop under inappropriate tax obligation bands because of the damaged appraisal of the residential property carried out in 1991. In 2005, the then UK federal government recommended a plan of re-assessing the tax bands of all the residential properties in England, but there were no application of the proposal in truth.

Consequently, many houses in England still drops under malfunctioning council (residential property) tax obligation bands as well as have actually been paying excess amount since last 20 years.

Nevertheless, people in England can currently check their council tax bands and also challenge the banding as well as hold the chances of winning back the extreme payment made considering that 1993. An appeal for redeeming their tax obligation can be made to the Local Listing Officer in England. Events can likewise forward their attract the Valuation Office Agency (VOA).

There are particular aspects that you require to do prior appealing for council tax re-banding as well as forwarding a proposal for reclaiming council tax obligation. By checking out VOA website, you can learn details about council tax and also can likewise contrast the council tax band with homes in your location.

Examine your banding with the neighbor’s properties, compare the size and also age which will give you a clear sign regarding your base of testing your band. Additionally, take into consideration any extensions or change you may have made to your residential property as greater valuation can make your band greater.

As you contact the VOA, you will certainly be asked to describe the factors you believe your building banding is not right as well as likewise validate the information of the building. The VOA will after that examine the listing entrance as well as assess the points presented by you. If the VOA can not resolve the enquiry you sent, after that it will perform much more in-depth review of your real estate tax bands.

While many inquiries concerning property tax re-banding as well as recovering council tax can be done instantaneously, in many cases, you can additionally submit a ‘legitimate’ proposition to the VOA to re-value your banding. The VOA will certainly accept a proposition which they regard to be “valid” and if it discovers your proposition invalid, it will not take your proposal into account as well as will certainly likewise give the reason why they have actually termed your proposal as invalid. In that instance, you can appeal the invalidity decision to the Valuation Tribunal.

Appealing for real estate tax re-assessment and also submitting a proposal for redeeming council tax can be a headache as well as thus lots of independent council tax obligation review companies have actually introduced to help the willing celebrations to onward their claims, accumulate needed proof and submit detailed record to VOA. These companies have the necessary competence and experience as well as hence can seek their help while reclaiming council(building) tax obligation.

They writes informative articles that recommended you read to help the readers understand the council tax

No Comment